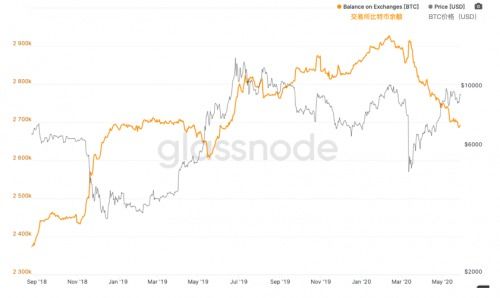

Bitcoin RealTime Market Graph

Bitcoin's realtime market graph provides valuable insights into the current price movement and trends of the world's leading cryptocurrency. Below is a detailed analysis of Bitcoin's recent market performance, along with some guidance on interpreting the graph and making informed trading decisions.

Bitcoin's market is known for its volatility, characterized by rapid price fluctuations and sudden shifts in sentiment. Traders and investors closely monitor realtime market graphs to capitalize on price movements and identify potential trading opportunities.

The graph displays Bitcoin's price movement over a specified time frame, typically ranging from minutes to hours. Each data point represents the price of Bitcoin at a particular moment, plotted against time.

Volume bars beneath the price graph indicate the trading volume during each interval. High volume often accompanies significant price movements, indicating increased market participation and liquidity.

Various technical indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands may overlay the price graph. These indicators offer insights into market momentum, trend direction, and potential reversal points.

Key support and resistance levels, derived from historical price data, may be marked on the graph. These levels represent areas where the price has historically struggled to move beyond (resistance) or found buying interest (support).

Bitcoin's recent performance has been characterized by [volatility/stability], influenced by factors such as [macroeconomic trends, regulatory developments, institutional adoption, etc.].

As per the latest data, Bitcoin is [trending upwards/downwards/sideways]. The trend may be influenced by [news events, market sentiment, technical factors, etc.].

Traders may adopt a trendfollowing strategy, entering long positions during uptrends and short positions during downtrends. Confirmation from technical indicators can validate the trend direction.

In choppy or sideways markets, range trading strategies can be profitable. Traders buy near support levels and sell near resistance levels, exploiting price oscillations within a defined range.

Breakout traders aim to capitalize on significant price movements beyond key support or resistance levels. They enter positions once the price breaks decisively above resistance or below support, expecting a continuation of the breakout.

Risk should be managed by appropriately sizing positions based on account size and risk tolerance. Traders often limit their risk per trade to a certain percentage of their trading capital.

Using stoploss orders is essential to mitigate potential losses. These orders automatically exit positions if the price moves against the trader beyond a predetermined level.

Diversifying across multiple assets or trading strategies can reduce overall portfolio risk. Bitcoin's volatility makes diversification especially important for risk management.

Bitcoin's realtime market graph provides valuable insights for traders and investors, helping them navigate the dynamic cryptocurrency markets. By interpreting key indicators, analyzing market trends, and implementing sound risk management practices, market participants can strive to achieve their trading objectives in the volatile world of Bitcoin.

文章已关闭评论!

2024-11-26 10:41:17

2024-11-26 10:39:49

2024-11-26 10:38:39

2024-11-26 10:37:33

2024-11-26 10:36:10

2024-11-26 10:34:42

2024-11-26 10:33:22

2024-11-26 10:32:03