Investing in Bitcoin requires careful consideration and strategic planning to mitigate risks and maximize returns. Whether you're a novice or seasoned investor, understanding the key factors and allocation strategies is crucial. Let's delve into the Bitcoin allocation requirements to help you make informed investment decisions.

Before allocating any funds to Bitcoin, assess your risk tolerance. Bitcoin is known for its volatility, and prices can fluctuate significantly in a short period. Determine how much risk you're willing to take and allocate accordingly. Consider your investment horizon, financial goals, and comfort level with market fluctuations.

Bitcoin should be part of a diversified investment portfolio. Experts recommend allocating a portion of your investment portfolio to Bitcoin, typically ranging from 1% to 5%, depending on your risk tolerance and investment objectives. Diversification helps spread risk across different asset classes and reduces exposure to any single investment.

Your investment horizon plays a crucial role in determining your Bitcoin allocation. If you have a longterm investment horizon and can withstand shortterm price fluctuations, you may consider allocating a higher percentage of your portfolio to Bitcoin. Conversely, if your investment horizon is shortterm, a smaller allocation may be more appropriate.

Align your Bitcoin allocation with your financial goals. If your goal is wealth preservation or hedging against inflation, Bitcoin may serve as a valuable asset in your portfolio. However, if your primary objective is capital preservation or income generation, allocate accordingly to meet your specific needs.

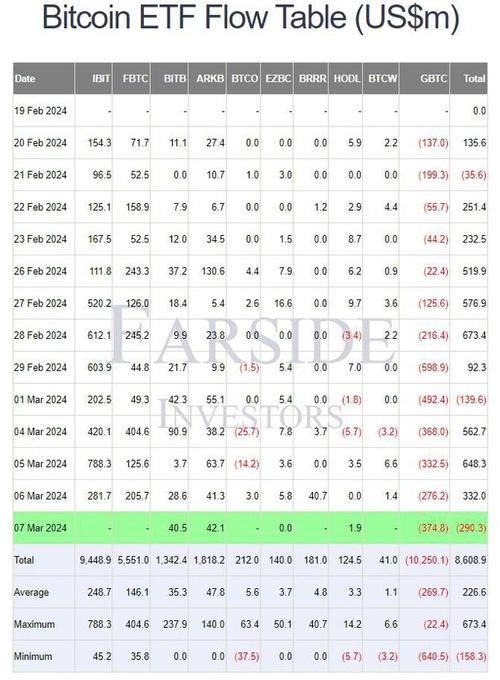

Monitor market conditions and macroeconomic factors that may impact Bitcoin prices. Consider factors such as regulatory developments, technological advancements, macroeconomic trends, and investor sentiment. Adjust your Bitcoin allocation based on changing market dynamics to optimize your portfolio performance.

Consider implementing a dollarcost averaging strategy when investing in Bitcoin. DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This approach helps mitigate the impact of volatility and allows you to accumulate Bitcoin over time at varying price levels.

Implement risk management strategies to protect your investment. Set stoploss orders to limit potential losses and establish exit criteria based on predefined metrics. Consider diversifying within the cryptocurrency space by allocating to other digital assets besides Bitcoin to spread risk further.

Conduct thorough research before allocating funds to Bitcoin. Understand the fundamentals of Bitcoin, including its technology, use cases, supply dynamics, and network security. Stay informed about industry developments and evolving regulatory landscape to make informed investment decisions.

Allocating funds to Bitcoin requires a disciplined approach and careful consideration of various factors, including risk tolerance, asset allocation, investment horizon, financial goals, market conditions, dollarcost averaging, risk management, and due diligence. By following these guidelines and continuously monitoring your investment, you can optimize your Bitcoin allocation and position yourself for longterm success in the cryptocurrency market.

Remember, investing in Bitcoin carries inherent risks, and past performance is not indicative of future results. It's essential to consult with a financial advisor or investment professional to tailor your Bitcoin allocation to your specific financial situation and investment objectives.

This comprehensive guide covers the essential aspects of Bitcoin allocation requirements, offering actionable insights for investors at any level.

文章已关闭评论!

2024-11-26 07:20:08

2024-11-26 07:18:45

2024-11-26 07:17:24

2024-11-26 07:16:19

2024-11-26 07:14:54

2024-11-26 07:13:27

2024-11-26 07:12:19

2024-11-26 07:11:06