Bitcoin, the pioneering cryptocurrency, has captured the imagination of investors worldwide, promising lucrative returns and potentially lifechanging wealth. However, assessing the probability of achieving such wealth requires a nuanced understanding of various factors.

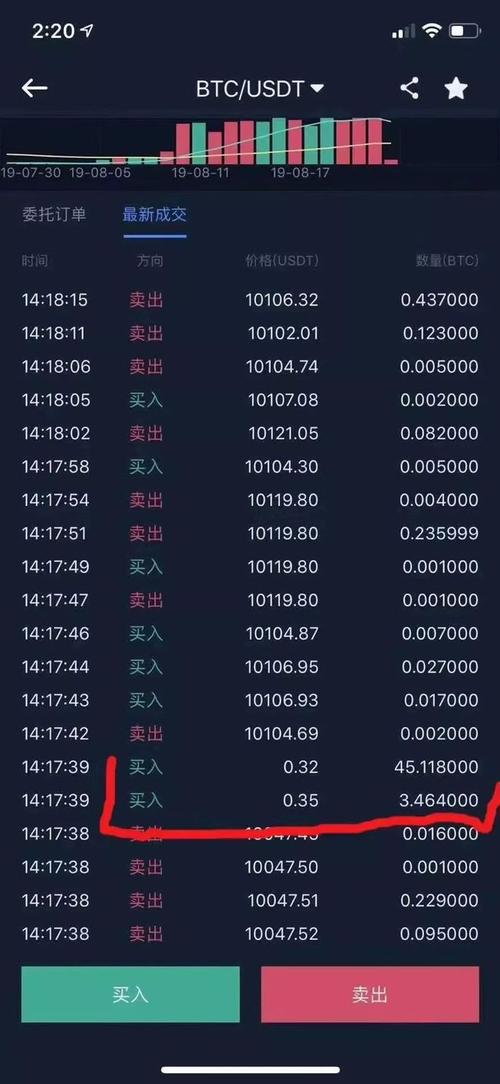

Bitcoin's price volatility is notorious, characterized by significant fluctuations within short timeframes. While this volatility presents opportunities for substantial gains, it also entails substantial risk. Investing in Bitcoin requires a high tolerance for risk, as the potential for losses is equally substantial.

The cryptocurrency market operates 24/7, with prices influenced by numerous factors including supply and demand dynamics, regulatory developments, technological advancements, and macroeconomic trends. Predicting Bitcoin's price movements with certainty is virtually impossible, making it a speculative asset class.

Bitcoin's historical performance has been remarkable, with early adopters witnessing exponential gains. However, past performance is not indicative of future results. While some investors have become overnight millionaires, others have experienced significant losses.

Bitcoin's price is influenced by economic factors such as inflation, interest rates, and geopolitical events. Moreover, regulatory actions by governments and financial institutions can impact Bitcoin's adoption and price stability. Investors must stay informed about regulatory developments to mitigate risks.

Technological advancements in blockchain technology, scalability solutions, and institutional adoption can positively influence Bitcoin's longterm prospects. However, technological innovation also introduces risks, such as security vulnerabilities and network upgrades.

Investing in Bitcoin should be part of a welldiversified investment portfolio, considering an individual's risk tolerance, investment goals, and time horizon. Diversification across asset classes can mitigate risks associated with Bitcoin's volatility and enhance overall portfolio resilience.

While the allure of Bitcoin as a pathway to riches is undeniable, the probability of achieving such wealth is uncertain and highly subjective. Investors should approach Bitcoin investment with caution, conducting thorough research, understanding the risks involved, and adopting a disciplined investment strategy.

文章已关闭评论!

2024-11-26 10:32:03

2024-11-26 10:30:47

2024-11-26 10:29:33

2024-11-26 10:28:26

2024-11-26 10:27:13

2024-11-26 10:26:04

2024-11-26 10:24:55

2024-11-26 10:23:27