Bitcoin, as a highly volatile asset, has experienced various price fluctuations since its inception. Determining its absolute lowest price requires examining historical data and understanding the factors influencing its value. Let's delve into this intriguing topic.

Bitcoin's journey began in 2009, initially valued at negligible amounts. Over the years, it witnessed significant growth and volatility, marked by several price corrections and rallies. To pinpoint its lowest price, we must analyze pivotal moments in its history.

During its infancy, Bitcoin traded at fractions of a cent, mainly used by enthusiasts and techsavvy individuals. However, there wasn't a significant market or exchange infrastructure to establish a definitive low point.

One of the most notable events in Bitcoin's history was the collapse of Mt. Gox, a prominent cryptocurrency exchange. In early 2014, Mt. Gox filed for bankruptcy after losing approximately 850,000 bitcoins, worth around $473 million at the time. This event led to a sharp decline in Bitcoin's price, reaching its lowest point in years.

After reaching an alltime high of nearly $20,000 in late 2017, Bitcoin entered a prolonged bear market throughout 2018. The price plummeted to around $3,200 in December 2018, marking the lowest point in that market cycle. Factors such as regulatory uncertainties, security breaches, and market manipulation contributed to this decline.

The outbreak of the COVID19 pandemic in early 2020 triggered a global economic downturn, affecting various asset classes, including cryptocurrencies. In March 2020, Bitcoin's price dropped to around $3,800 amidst panic selling and liquidity concerns. However, it quickly rebounded, demonstrating resilience during uncertain times.

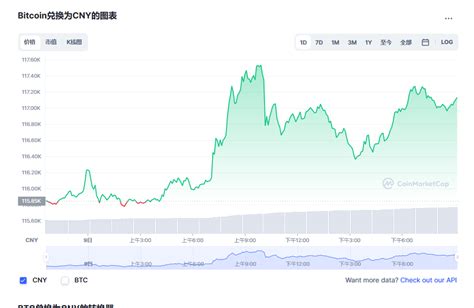

As of my last update in January 2022, Bitcoin's price had experienced significant fluctuations, influenced by macroeconomic factors, institutional adoption, regulatory developments, and market sentiment. While it's challenging to predict future price movements accurately, Bitcoin's volatility remains a defining characteristic.

Determining Bitcoin's absolute lowest price requires context and perspective, considering the evolving landscape of the cryptocurrency market. While specific events like the Mt. Gox collapse and the 2018 bear market represent significant downturns, Bitcoin's resilience and longterm growth trajectory demonstrate its potential as a transformative asset class.

Understanding Bitcoin's lowest price points can provide valuable insights for investors, analysts, and enthusiasts navigating the dynamic cryptocurrency market. However, it's essential to approach such analysis with a comprehensive understanding of historical trends and market dynamics.

1.

2.

3.

By combining historical analysis with current market insights, stakeholders can navigate the complexities of the cryptocurrency landscape and make informed decisions regarding Bitcoin and other digital assets.

This exploration of Bitcoin's lowest price points provides a foundational understanding of its market dynamics and underscores the importance of comprehensive research and risk management in cryptocurrency investing.

文章已关闭评论!

2024-11-26 10:26:04

2024-11-26 10:24:55

2024-11-26 10:23:27

2024-11-26 10:22:22

2024-11-26 10:21:14

2024-11-26 10:19:51

2024-11-26 10:18:36

2024-11-26 10:17:15