Title: Bitcoin Market Trends and Analysis

Bitcoin, the pioneer of cryptocurrencies, has seen significant fluctuations in its market trends over the years. Understanding these trends requires analyzing various factors such as adoption rates, regulatory developments, technological advancements, and market sentiment. Let's delve into the current trends shaping the Bitcoin market.

Adoption and Integration

1. Institutional Adoption:

One of the most notable trends in recent years is the increasing institutional adoption of Bitcoin. Institutional investors, hedge funds, and corporations have been allocating significant portions of their portfolios to Bitcoin as a hedge against inflation and economic uncertainty.

2. Payment Integration:

More businesses are accepting Bitcoin as a form of payment, which enhances its utility and mainstream acceptance. This trend is fueled by the growing demand for decentralized finance (DeFi) and the desire for borderless transactions.

Regulatory Environment

1. Regulatory Clarity:

Regulatory developments continue to play a crucial role in shaping Bitcoin's market trends. Clearer regulations in major economies provide investors with confidence and reduce uncertainty, potentially leading to increased investment and adoption.

2. Government Intervention:

On the flip side, government interventions or restrictive regulations can dampen market sentiment and hinder Bitcoin's growth. Traders closely monitor legislative actions and regulatory announcements for potential impacts on the market.

Technological Advancements

1. Layer 2 Solutions:

Scalability has been a persistent challenge for Bitcoin. However, the development of layer 2 solutions like the Lightning Network has improved transaction throughput and reduced fees, making Bitcoin more practical for everyday use.

2. Taproot Upgrade:

The Taproot upgrade, implemented in late 2021, enhances Bitcoin's privacy, security, and smart contract capabilities. This upgrade may attract developers to build more sophisticated applications on the Bitcoin blockchain.

Market Sentiment

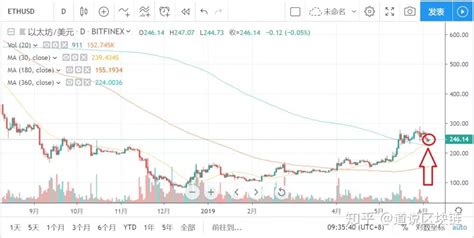

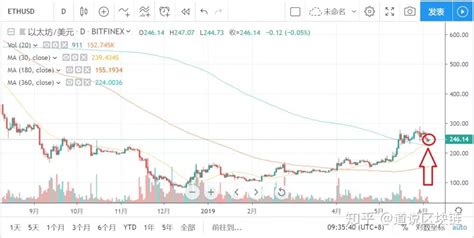

1. Volatility:

Bitcoin's market is notoriously volatile, with prices experiencing rapid fluctuations in short periods. Traders and investors need to be prepared for sudden price swings driven by various factors, including market speculation and macroeconomic events.

2. Investor Confidence:

Despite its volatility, Bitcoin has gained significant credibility as a store of value and an alternative investment asset. Positive sentiment from influential figures and institutions can drive prices higher, while negative news may trigger selloffs.

LongTerm Outlook and Recommendations

1. Diversification:

Investors should consider Bitcoin as part of a diversified investment strategy rather than relying solely on it. Diversification across different asset classes helps mitigate risks associated with Bitcoin's volatility.

2. Stay Informed:

Keeping abreast of regulatory developments, technological advancements, and market sentiment is crucial for making informed decisions in the Bitcoin market. Traders and investors should stay informed through reputable sources and analysis.

3. LongTerm Perspective:

Despite shortterm price fluctuations, Bitcoin's longterm fundamentals remain strong. Its limited supply, growing adoption, and underlying technology suggest a positive outlook for its value over the long term.

In conclusion, the Bitcoin market is influenced by a combination of factors, including adoption trends, regulatory developments, technological advancements, and market sentiment. Understanding these trends and staying informed is essential for navigating the dynamic landscape of Bitcoin investing. While volatility remains a challenge, Bitcoin's potential as a transformative financial asset cannot be overlooked.

文章已关闭评论!