Title: Understanding Bitcoin's Top Divergence and Its Implications

Bitcoin, as the pioneering cryptocurrency, has garnered immense attention and investment interest over the years. One of the key aspects that traders and investors closely monitor is its price movements. The concept of "top divergence" in Bitcoin refers to a scenario where the price reaches a peak, but the indicators suggest a weakening trend or reversal. Understanding this phenomenon and its implications is crucial for market participants.

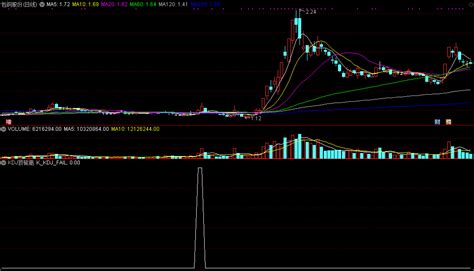

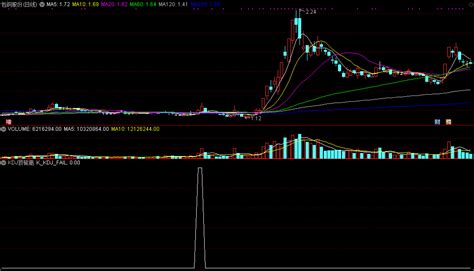

Top divergence occurs when the price of an asset, in this case, Bitcoin, reaches a new high, but the indicators, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or the volume, fail to confirm this upward movement. It indicates a weakening momentum and often precedes a potential trend reversal.

Traders and analysts use various technical analysis tools to identify top divergence in Bitcoin:

- RSI: A divergence between the price of Bitcoin and its RSI can signal a potential reversal. If the price makes a higher high while the RSI makes a lower high, it indicates weakening momentum.

- MACD: Similar to RSI, a bearish divergence between the MACD line and the price suggests a weakening trend. If the price continues to rise while the MACD line forms lower highs, it indicates a possible reversal.

- Volume: Declining volume as the price reaches new highs is another sign of potential top divergence. Low volume indicates lack of conviction from buyers, making the upward movement unsustainable.

Understanding the implications of top divergence in Bitcoin is essential for traders and investors:

- Potential Trend Reversal: Top divergence often precedes a trend reversal, signaling a shift from bullish to bearish sentiment. Traders may consider exiting long positions or even initiating short positions.

- Volatility: Following top divergence, increased volatility is common as the market participants react to the weakening momentum. This volatility can present both opportunities and risks for traders.

- Correction or Consolidation: After top divergence, Bitcoin may experience a corrective phase or enter a period of consolidation as the market reassesses its value. This phase is crucial for establishing new support levels.

For investors and traders navigating Bitcoin top divergence, the following guidance can be helpful:

- Risk Management: Implement robust risk management strategies to mitigate potential losses during periods of increased volatility. This includes setting stoploss orders and diversifying your portfolio.

- Stay Informed: Continuously monitor technical indicators and market sentiment to stay ahead of potential trend reversals. Keeping abreast of news and developments in the cryptocurrency space is also crucial.

- Adaptability: Be prepared to adapt your trading strategy based on evolving market conditions. Flexibility is key to navigating the dynamic nature of cryptocurrency markets.

Top divergence in Bitcoin serves as a valuable indicator for traders and investors, signaling potential trend reversals and increased volatility. By understanding this concept and its implications, market participants can make informed decisions and navigate the everchanging landscape of cryptocurrency markets with greater confidence.

文章已关闭评论!