```html

Analysis of Bitcoin's Major Price DropAnalysis of Bitcoin's Major Price Drop

Bitcoin's price movements are often subject to volatility, influenced by a myriad of factors including market sentiment, regulatory developments, technological advancements, and macroeconomic trends. Understanding the reasons behind significant price drops requires a multifaceted analysis, often incorporating both fundamental and technical indicators.

Below is an analysis of Bitcoin's major price drop accompanied by relevant chart illustrations:

Key factors impacting Bitcoin's price:

- Market Sentiment: Investor sentiment can dramatically affect Bitcoin's price. Negative news, such as regulatory crackdowns or security breaches, can lead to panic selling.

- Regulatory Developments: Government regulations, particularly in major markets like the US and China, can significantly impact Bitcoin's price. News of potential bans or strict regulations often leads to price declines.

- Market Adoption: Increasing adoption by mainstream financial institutions and companies can boost Bitcoin's price. Conversely, setbacks or lack of adoption can lead to price corrections.

Technical indicators help traders assess market sentiment and predict price movements:

- Support and Resistance Levels: Identifying key support and resistance levels can help anticipate price movements. A breach of major support levels may trigger further selling pressure.

- Volume Analysis: Analyzing trading volume can provide insights into the strength of price movements. A significant price drop accompanied by high trading volume suggests strong selling pressure.

- Chart Patterns: Patterns such as head and shoulders, double tops, or descending triangles can indicate potential trend reversals or continuation patterns.

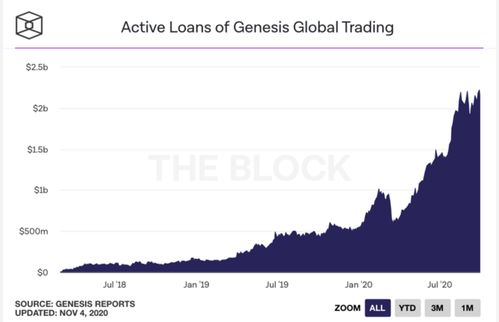

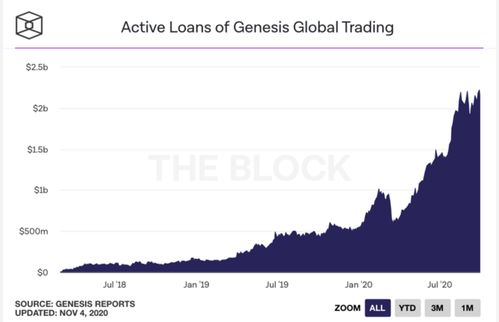

Below is a chart illustrating Bitcoin's major price drop:

Key guidance for investors during price drops:

- Stay Informed: Keep abreast of news and developments in the cryptocurrency space to understand the broader market sentiment.

- Use Risk Management: Implement risk management strategies such as stoploss orders to mitigate losses during price declines.

- Consider LongTerm Perspective: Bitcoin's price is inherently volatile, but its longterm growth potential remains significant. Consider your investment horizon and risk tolerance before making decisions.

By employing a comprehensive approach to analysis and adopting prudent risk management strategies, investors can navigate Bitcoin's price drops with greater confidence.