Title: Analyzing Bitcoin's Monday Trends

Bitcoin's price trends are a subject of intense interest and speculation, especially given its volatile nature. Let's delve into the trends of Bitcoin on Mondays, examining historical data, factors influencing prices, and potential strategies for investors.

Understanding Bitcoin's Monday Trends

Bitcoin, the pioneer of cryptocurrencies, has exhibited distinctive patterns in its price movements over the years. Analyzing its performance on Mondays can provide insights into market sentiment, trading behaviors, and broader economic factors.

Historical Analysis

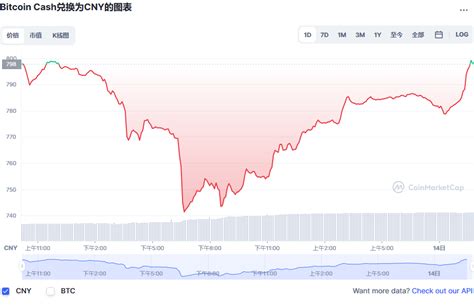

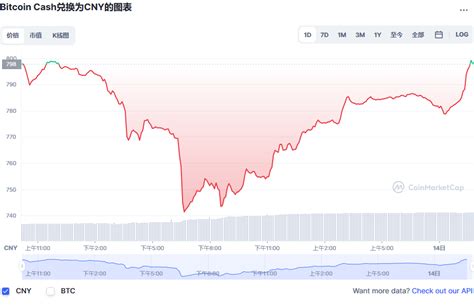

Examining historical data reveals interesting trends in Bitcoin's Monday performance. While cryptocurrency markets operate 24/7, trading activity often intensifies at the beginning of the week as traditional financial markets resume operations after the weekend.

1.

Monday Volatility

: Mondays tend to witness heightened volatility in Bitcoin prices compared to other weekdays. This phenomenon can be attributed to several factors, including weekend news developments, investor sentiment, and trading volumes.

2.

Price Fluctuations

: Bitcoin's price on Mondays often reflects the overall sentiment in the market. Positive news or developments over the weekend may lead to bullish trends, while negative events can trigger bearish sentiments, resulting in price fluctuations.

3.

Trading Volume

: Trading volume, particularly at the beginning of the week, plays a crucial role in shaping Bitcoin's Monday trends. Higher trading volumes indicate increased market participation and can amplify price movements.

Factors Influencing Bitcoin's Monday Trends

Several factors influence Bitcoin's performance on Mondays, affecting investor sentiment and market dynamics:

1.

Market Sentiment

: Investor sentiment, influenced by news, events, and regulatory developments, significantly impacts Bitcoin's Monday trends. Positive sentiments, such as institutional adoption or regulatory clarity, often drive prices higher, while negative sentiments can lead to selloffs.

2.

Technical Analysis

: Traders often rely on technical analysis indicators, such as moving averages, support and resistance levels, and trading volumes, to predict Bitcoin's price movements on Mondays and devise trading strategies accordingly.

3.

Macroeconomic Factors

: Global economic indicators, geopolitical events, and monetary policies can also influence Bitcoin's Monday trends. Economic instability or inflationary pressures may drive investors towards Bitcoin as a hedge against traditional assets.

Strategies for Investors

Navigating Bitcoin's Monday trends requires a comprehensive understanding of market dynamics and risk management strategies:

1.

Stay Informed

: Stay updated on news and events over the weekend that could impact Bitcoin's price on Monday. Follow reputable sources and consider the broader implications of developments on the cryptocurrency market.

2.

Risk Management

: Manage your risk exposure effectively by diversifying your investment portfolio and setting stoploss orders to mitigate potential losses during volatile trading periods.

3.

Technical Analysis

: Utilize technical analysis tools and indicators to identify key support and resistance levels, trend reversals, and potential entry or exit points for your trades.

4.

LongTerm Perspective

: Maintain a longterm perspective when investing in Bitcoin, focusing on its fundamentals, adoption trends, and potential as a store of value rather than shortterm price fluctuations.

Conclusion

Analyzing Bitcoin's Monday trends provides valuable insights into market dynamics, investor sentiment, and trading patterns. By understanding historical data, factors influencing prices, and implementing effective strategies, investors can navigate volatility and capitalize on opportunities in the cryptocurrency market. Stay informed, manage risks prudently, and maintain a longterm perspective to succeed in your Bitcoin investment journey.

文章已关闭评论!