Bitcoin whale tracking metrics provide valuable insights into the behavior and activities of large holders within the cryptocurrency ecosystem. These metrics offer crucial information for traders, investors, and analysts to gauge market sentiment, identify potential price movements, and assess the overall health of the Bitcoin network. Let's delve into some key whale tracking indicators and their significance:

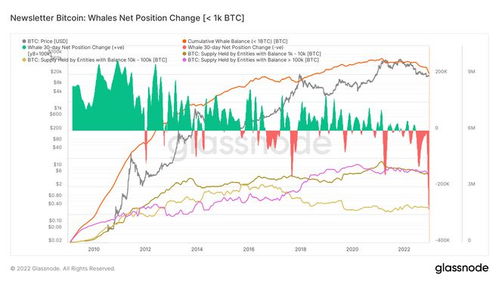

This metric tracks the movement of large Bitcoin holders, often referred to as "whales." By monitoring whether whales are accumulating or distributing their holdings, investors can gauge their sentiment towards the market. Accumulation by whales may indicate confidence in future price appreciation, while distribution could signal a bearish outlook.

Analyzing the distribution of Bitcoin across different wallet sizes provides insights into wealth distribution within the network. Significant fluctuations in the balances of large wallets can indicate largescale buying or selling activity by whales, influencing market dynamics.

Monitoring the flow of Bitcoin to and from exchanges offers clues about whale trading behavior. Sudden inflows of Bitcoin into exchanges may signal intentions to sell, potentially exerting downward pressure on prices. Conversely, outflows could indicate accumulation or a shift towards longterm holding strategies.

Tracking large Bitcoin transactions provides visibility into significant movements of funds between wallets. Analyzing the frequency and size of these transactions can help identify potential marketmoving events initiated by whales, such as major purchases, sales, or transfers to cold storage for longterm holding.

Several platforms and tools specialize in monitoring whale activity, offering realtime data and analytics to users. These tools aggregate data from blockchain explorers and exchange APIs, providing insights into whale behavior, accumulation patterns, and potential market trends.

By understanding and interpreting whale tracking metrics effectively, investors can make more informed decisions in navigating the dynamic landscape of the Bitcoin market. However, it's essential to exercise caution and conduct thorough research before making any investment decisions in the cryptocurrency space.

文章已关闭评论!

2024-11-26 14:25:30

2024-11-26 14:24:24

2024-11-26 14:23:04

2024-11-26 14:21:32

2024-11-26 14:20:06

2024-11-26 14:18:39

2024-11-26 14:17:28

2024-11-26 14:16:16