Blockchain technology has been a gamechanger across various industries, offering solutions for transparency, security, and efficiency. Among its many applications, the establishment of blockchainbased funds has emerged as a significant trend. These funds leverage blockchain's decentralized nature and cryptographic security to offer unique investment opportunities. Let's delve into some of the biggest beneficiaries of blockchain in the realm of funds.

One of the primary beneficiaries of blockchain technology is the venture capital sector. Blockchainbased venture capital funds provide a platform for investors to support promising startups working on blockchainrelated projects. These funds offer diversified portfolios that include investments in blockchain infrastructure, decentralized applications (DApps), protocols, and other innovative ventures.

Guidance: Investors looking to participate in blockchain venture capital funds should conduct thorough research on the fund's track record, investment strategy, and the expertise of its management team. Due diligence is crucial, as the blockchain space is dynamic and requires a deep understanding of technology, market trends, and regulatory considerations.

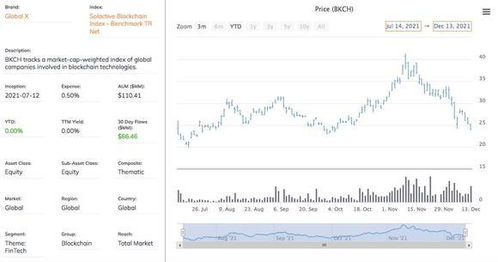

As the cryptocurrency market continues to mature, index funds have gained popularity among investors seeking diversified exposure to digital assets. These funds typically track the performance of a specific index, such as the top cryptocurrencies by market capitalization. Blockchain technology facilitates the creation and management of these funds through smart contracts and decentralized platforms.

Guidance: Investors interested in cryptocurrency index funds should assess factors such as fund fees, asset allocation methodology, rebalancing frequency, and custody solutions. Additionally, understanding the underlying constituents of the index and their respective fundamentals is essential for making informed investment decisions.

Tokenization, enabled by blockchain technology, allows for the representation of realworld assets, such as real estate, equities, and commodities, as digital tokens on a blockchain. Tokenized asset funds leverage this capability to offer fractional ownership of diversified portfolios, providing liquidity and accessibility to traditionally illiquid assets.

Guidance: Investors considering tokenized asset funds should evaluate the quality of the underlying assets, regulatory compliance, liquidity provisions, and the integrity of the tokenization platform. Understanding the legal and jurisdictional aspects of tokenized assets is essential to mitigate risks and ensure compliance with relevant regulations.

Decentralized Autonomous Organizations (DAOs) represent a novel approach to fund management, leveraging blockchain technology to enable decentralized decisionmaking and governance. DAOs operate through smart contracts, allowing stakeholders to vote on investment proposals, asset allocation strategies, and fund management activities in a transparent and autonomous manner.

Guidance: Participants interested in DAOs should assess factors such as governance mechanisms, voting procedures, smart contract security, and the alignment of incentives among stakeholders. Due to the experimental nature of DAOs and the potential for regulatory scrutiny, participants should exercise caution and stay informed about legal developments in this area.

Blockchain technology has revolutionized the fund management landscape, offering innovative solutions for investment diversification, transparency, and accessibility. Whether through venture capital funds, cryptocurrency index funds, tokenized asset funds, or decentralized autonomous funds, investors have a plethora of options to explore in the blockchain space. However, it is essential to conduct thorough due diligence, stay informed about regulatory developments, and assess risk factors before participating in blockchainbased funds.

文章已关闭评论!

2024-11-26 12:37:31

2024-11-26 12:36:13

2024-11-26 12:35:06

2024-11-26 12:33:52

2024-11-26 12:32:26

2024-11-26 12:31:08

2024-11-26 12:29:41

2024-11-26 12:28:27