Title: Analyzing Bitcoin's Performance Over Six Months

Bitcoin, the pioneer cryptocurrency, has captivated the financial world with its volatile nature and potential for substantial returns. Examining its performance over a sixmonth period can provide insights into its trends and fluctuations.

Over the past six months, Bitcoin's price has experienced significant fluctuations influenced by various factors:

- Market Sentiment: Investor sentiment plays a crucial role in Bitcoin's price movements. Positive news, such as institutional adoption or regulatory acceptance, often leads to price rallies, while negative news can trigger selloffs.

- MacroEconomic Factors: Economic indicators, geopolitical events, and monetary policies of major economies can impact Bitcoin's price. For instance, economic uncertainty may drive investors towards Bitcoin as a hedge against inflation.

- Technical Developments: Upgrades to the Bitcoin network, advancements in blockchain technology, and changes in mining difficulty can influence price movements.

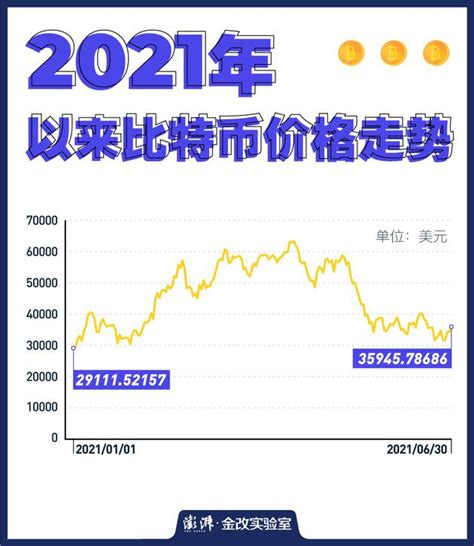

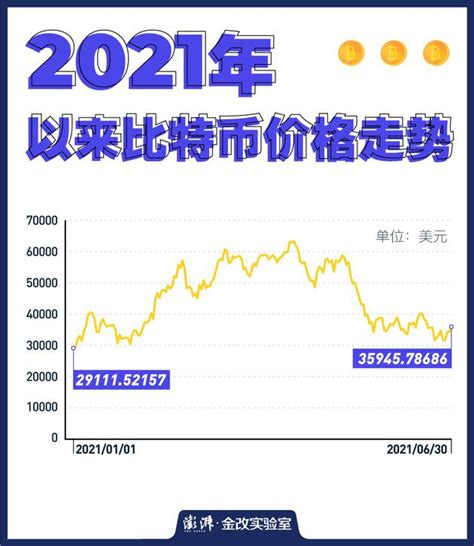

Charting Bitcoin's price over the past six months reveals several key trends:

- Bull and Bear Cycles: Bitcoin often experiences cycles of bullish uptrends followed by bearish corrections. These cycles are driven by market psychology, investor speculation, and fundamental factors.

- Volatility: Bitcoin's price is highly volatile, characterized by sharp fluctuations within short timeframes. Traders capitalize on this volatility for shortterm gains, while longterm investors may find it challenging to navigate.

- Resistance and Support Levels: Technical analysis identifies critical support and resistance levels that influence Bitcoin's price movements. These levels are often determined by historical price data and trading volumes.

For investors considering Bitcoin as an asset, here are some recommendations:

- Diversification: Bitcoin can be a volatile asset, so diversifying your investment portfolio across various asset classes can help mitigate risks.

- LongTerm Perspective: Despite shortterm volatility, Bitcoin has demonstrated strong longterm growth potential. Consider adopting a longterm investment strategy and hodling through price fluctuations.

- Stay Informed: Stay updated on market developments, regulatory changes, and technological advancements in the cryptocurrency space. Knowledge empowers informed decisionmaking.

- Risk Management: Set clear investment goals and risk tolerance levels. Only invest what you can afford to lose, and consider using risk management tools such as stoploss orders.

Bitcoin's performance over the past six months reflects its dynamic nature and the evolving landscape of the cryptocurrency market. By understanding the underlying factors driving price fluctuations and adopting prudent investment strategies, investors can navigate the volatility of Bitcoin and potentially capitalize on its longterm growth prospects.

文章已关闭评论!