Bitcoin's halving algorithm is a fundamental aspect of its design, influencing its scarcity and the dynamics of its supply and demand. Let's delve into the intricacies of this algorithm to grasp its significance.

Bitcoin, the pioneering cryptocurrency, operates on a decentralized network secured by cryptography. One of its defining features is its controlled issuance, primarily governed by the halving algorithm.

Bitcoin's total supply is capped at 21 million coins. Unlike traditional fiat currencies, which are subject to inflationary pressures, Bitcoin's supply is deflationary in nature. This scarcity is integral to its value proposition.

Approximately every four years or after every 210,000 blocks mined, the reward that miners receive for validating transactions on the Bitcoin network undergoes a halving. Initially set at 50 bitcoins per block, this reward is halved, leading to subsequent reductions.

The halving algorithm is hardcoded into the Bitcoin protocol. It adjusts the block reward by halving it after every set number of blocks, ensuring a diminishing issuance rate over time. This mechanism aims to mimic the scarcity of precious metals like gold.

By reducing the rate at which new bitcoins are introduced into circulation, halving events decrease the inflation rate of Bitcoin. This gradual reduction in supply growth contributes to its deflationary nature, potentially increasing its value over time.

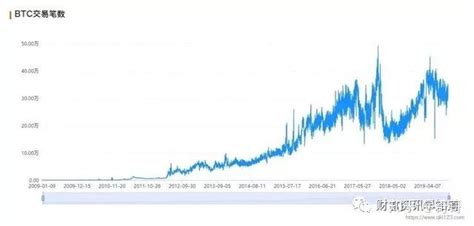

Historically, Bitcoin halving events have been associated with significant price movements. Anticipation of reduced supply often leads to increased demand, driving up prices. However, the extent and timing of price movements can vary due to various factors influencing market sentiment.

Halving events directly impact the economics of Bitcoin mining. With reduced block rewards, miners must rely more on transaction fees to sustain profitability. This dynamic incentivizes efficient mining operations and ensures the security and integrity of the network.

As halving events continue to occur and Bitcoin approaches its maximum supply, the significance of each halving intensifies. The diminishing issuance rate underscores Bitcoin's deflationary nature, potentially positioning it as a store of value akin to digital gold.

The Bitcoin halving algorithm is a crucial component of its monetary policy, influencing its supply dynamics and market behavior. Understanding its mechanics and implications is essential for grasping the longterm prospects of Bitcoin as a decentralized digital asset.

This algorithmic approach to issuance sets Bitcoin apart from traditional fiat currencies and underscores its potential as a hedge against inflation and a store of value in the digital age.

文章已关闭评论!

2024-11-26 09:32:19

2024-11-26 09:30:57

2024-11-26 09:29:41

2024-11-26 09:28:14

2024-11-26 09:27:06

2024-11-26 09:25:40

2024-11-26 09:24:16

2024-11-26 09:22:00